The exact same instance relates to those that do not possess a car - deductibles. Non-owner automobile insurance policy is the suitable option for those that do not possess an auto since typical automobile insurance can be expensive. That suggests that such people will be covered in the occasion of an additional accident, and they can also reveal evidence of liability insurance protection to get their certificate reinstated.

The reason that non-owner SR-22 insurance coverage is less expensive is that the insurance provider assumes that you do not drive typically, and the only protection you get, in this situation, is for obligation just (deductibles). If you lease or obtain lorries frequently, you need to consider non-owner automobile insurance coverage too. Although prices can vary throughout insurance firms, the average annual expense for non-owner auto insurance coverage in The golden state stands at $932.

Demands for An SR-22 in The golden state First, understand that an SR-22 influences your auto insurance coverage expense and also protection. As an example, after a DUI conviction in California, conventional drivers pay an average of 166% greater than auto coverage for SR-22 insurance policy. The minimal duration for having an SR-22 in California is 3 years, yet one may need it longer than that, relying on their case and offense.

In any one of these situations, an SR-26 kind can be filed by your insurance provider. When that takes place, your insurance company ought to suggest that you no more have insurance policy coverage with the entity. Beginning the SR-22 process over once more will be necessary if your company files an SR-26 prior to completing your SR-22 requirement.

MIS-Insurance deals affordable SR22 insurance coverage that will save you cash over the life of your policy. Affordable SR22 insurance policy is readily available and we will certainly can aid you secure the appropriate policy for you. The reason is that each insurance provider uses its standards when reviewing your driving history. On the other hand, The golden state regulation forbids firms from raising prices or terminating your plan in the middle of its term.

A drunk driving will instantly raise your prices without considering additional rate rises and also reject you price cuts also if you were previously receiving an excellent driver discount. For instance, as opposed to paying $100 regular monthly for auto insurance, a driver with no DUI background will only pay $80 monthly, many thanks to the 20% excellent chauffeur discount rate they get.

Rumored Buzz on Financial Responsibility > Insurance Requirements/sr-22

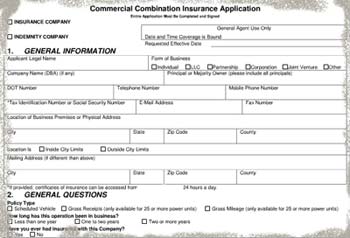

What you require to find out about SR-22 Declaring in The golden state When it concerns issues relating to car insurance coverage, our driving records, as well as rights and benefits, in some cases we are instructed things that just are not real. credit score. Let's take a look at a few of the most typical misconceptions and mistaken beliefs pertaining to the SR-22 The golden state: What is the SR-22 Driver Filing? An SR-22 is a certification of insurance filed by your insurance coverage business directly to the Department of Motor Vehicles.

SR-22 Minimum Obligation Purview The minimum responsibility limits have to fulfill your state's needs. Your Cost-U-Less consumer service rep can inform you what the minimal requirements are for your state. car insurance. Exactly How the SR-22 Filing Process Works There is very little for you to do in this procedure. All you have to do is request your insurer to file an SR-22 for you, after that the insurance policy firm takes treatment of the rest.

Prevent Future SR-22 Terminations as well as Suspensions Once you have your SR-22 insurance coverage, you desire to make certain it does not get terminated or put on hold. The earlier you restore it, the much safer you'll be and also the less likely your SR-22 will be terminated.

insurance group car insurance insure sr-22 insurance motor vehicle safety

insurance group car insurance insure sr-22 insurance motor vehicle safety

You need to pay $55,000. 00 in protections with the state treasurer! When Is an SR-22 Called for? Not all states require an SR-22, but the ones that do might need them for any of the following reasons: Unsatisfied Judgments Major Convictions License Suspensions No Insurance Policy Violations No Insurance Policy At The Time Of The Accident California SR-22 Declaring Cost-U-Less can aid you file an SR-22 in California as well as we can also help you get affordable SR-22 insurance coverage.

Although declaring charges are rather reduced, chauffeurs that need SR-22 insurance will locate that their rates are more costly as a result of the DUI or other violation that led to the SR-22 demand in the first area (division of motor vehicles). Exactly how much does SR-22 price in The golden state? SR-22 insurance policy in The golden state will certainly set you back more than what you formerly spent for vehicle insurance, yet this is mainly as a result of the violation that caused you to require an SR-22 filing.

Whether or not your current insurer will file an SR-22 for you, one of the simplest means to make certain you're getting the most inexpensive SR-22 coverage is to contrast quotes from multiple firms. Many major insurance companies in California, including Progressive as well as Geico, will certainly submit SR-22 kinds. Since every insurer evaluates your motoring history according to its own standards, we advise comparing at the very least three quotes to guarantee you're getting the finest rates.

The Single Strategy To Use For What Is Sr22 Insurance - Sr22 Form - Direct Auto Insurance

As an example, a vehicle driver with no-DUI history paying $100 each month for vehicle insurance policy may get a 20% excellent vehicle driver discount rate and also only pay $80 per month. motor vehicle safety. After obtaining a DUI, the chauffeur will certainly be back to paying a minimum of $100 each month, which is 25% more than the prior price cut rate.

Note that the SR-22 insurance coverage plan requires to note all cars you possess or regularly drive (driver's license). How much time do you need to have an SR-22? The length of time you'll need to keep SR-22 depends upon your conviction, which need to mention for how long you're anticipated to keep the SR-22 declaring.

Maintaining constant insurance coverage is necessary. Any kind of gaps in your SR-22 cars and truck insurance policy will trigger your driving advantages to be suspended once again, as your insurance firm would certainly file an SR-26 type with the DMV alerting them of the lapse - insure. If you vacate The golden state during your required filing duration, you'll need to situate an insurance provider that does organization in both states and is willing to submit the form for you in the state.

During the ten years complying with a DUI, you will not be eligible for a good chauffeur price cut in The golden state (insurance). After this duration has run out, the drunk driving will be eliminated from your driving document and also you will certainly be eligible for the discount once more. You may be able to obtain the sentence eliminated from your document earlier, but so long as you remain with the very same insurance provider, the company will learn about the drunk driving and also remain to use it when determining your SR-22 insurance coverage prices.

It supplies protection if you occasionally drive various other people's automobiles with their consent. For those that don't have a car, non-owner SR-22 insurance coverage is a policy that offers the state-required obligation insurance policy however is connected to you as the driver, regardless of which vehicle you utilize. One of the advantages of non-owner SR-22 insurance coverage is that quotes are commonly less costly than for a proprietor's plan, given that you'll only obtain liability insurance coverage and also the insurance provider presumes you drive less frequently. sr22 coverage.

These prices were publicly sourced from insurance firm filings as well as ought to be made use of for comparative objectives just your own quotes may be different - sr-22.

The Basic Principles Of Sr-22 Insurance: Compare Quotes And Find Cheap Coverage

dui division of motor vehicles auto insurance motor vehicle safety credit score

dui division of motor vehicles auto insurance motor vehicle safety credit score

sr22 liability insurance coverage underinsured ignition interlock

sr22 liability insurance coverage underinsured ignition interlock

vehicle insurance credit score car insurance insurance car insurance

vehicle insurance credit score car insurance insurance car insurance

SR 22 Insurance policy There is a range of sorts of auto insurance policy that you are likely aware of - from liability to thorough to collision - but one kind you may not recognize is SR22 insurance coverage. SR22 insurance coverage is an accreditation of economic responsibility and also is generally mandated by a court order complying with a sentence for a significant web traffic offense (auto insurance).

What is SR22 automobile insurance? Commonly referred to as SR22 auto insurance policy, an SR22 is not really insurance, yet rather a qualification of economic obligation submitted to the Division (DMV) or Bureau of Electric Motor Cars (BMV) on the insurance holder's behalf - motor vehicle safety. It mentions that the insurance holder has the mandated insurance coverage limits stated by a court order after an infraction.

These offenses may include the following: - among one of the most common reasons for an SR22 mandate is due to a driving under the impact sentence. This applies to those founded guilty of driving while intoxicated or intoxicated of drugs that restrict the vehicle driver's capability. no-fault insurance. - a person who is founded guilty of a significant web traffic infraction such as driving negligently or carelessly, generally over of 20 mph over the speed limitation, might be called for to have SR22 vehicle insurance.

- if a chauffeur remains in a mishap and also does not have insurance policy protection, the court might need them to have SR22 protection after the crash. insurance. - vehicle drivers seeking reinstatement after having actually a revoked or put on hold license will commonly be called for to have SR22 automobile insurance coverage before they're granted approval to drive once again.

auto insurance motor vehicle safety underinsured coverage insure

auto insurance motor vehicle safety underinsured coverage insure

Those that already have coverage will certainly not need to obtain new insurance unless the service provider drops them. Once the SR22 is submitted with the state, the insurance holder does not have to do anything other than keep the coverage (motor vehicle safety). SR-22 Insurance Providers Where to get an SR22 Lots of insurance policy providers offer SR22 coverage; the insurance policy holder simply has to request that a duplicate of their policy be submitted to the DMV or BMV, depending upon the state.

If you are gotten to carry an SR22, it is a great concept to look around for insurance coverage. Getting SR22 Cars And Truck Insurance Acquiring SR22 automobile insurance policy is an easy process. When you pick an insurance provider for your protection, it can submit the submitting the very same day you request it.

The Only Guide for How Long Do You Need Sr22 Insurance In Ohio? - Sapling

Those that call for a paper declaring can take a couple of days to finish. How will an SR22 impact the expense of my insurance policy? While the declaring fee for the SR22 is reduced or no-cost, with the required (sr-22 insurance). This occurs since motorists that are required to have an SR22 are thought about high-risk by insurance coverage business.

It is essential Click here to find out more to bear in mind that you will be in charge of the cost of your insurance deductible if you are included in an accident so always select an insurance deductible that you can pay for. An additional method to lower the costs expense is to consider the type of lorry you drive. High-end and also sporting activities automobiles often tend to be much more expensive than sedans as well as various other lorries with high security scores - motor vehicle safety.

Some insurance coverage firms supply particular discounts on premiums so speak to your agent and also discover out for what you might certify. bureau of motor vehicles.